what is maryland earned income credit

The state EITC reduces the amount of. That deadline passed on Friday.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

. The maximum federal credit is 6728. When both you and your spouse have taxable income you may subtract up to 1200. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

The bill also includes a child tax credit for people who make a federal adjusted gross income of 6000 or less and have dependents with disabilities under. Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

Thestate EITCreducesthe amount of Maryland tax you. The earned income tax credit EITC is a refundable tax credit that helps certain US. What Is The Maryland Tax Credit.

State refundable tax credits like the California Earned. The maximum credit for the 2020 tax year is 6660 and the maximum income to qualify for any credit is 56844. The IRS last month began alerting 9 million people that they could still claim thousands in stimulus and Child Tax Credit payments.

The amount of credit varies depending on your income and how many dependents you have. Earned income tax credits EITC are a common strategy used by governments to bolster the. Election to use prior-year earned income.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. By Eduardo Peters August 15 2022 August 15 2022 For each additional 1000 of income above 30000 you add 90 to 1680 to find the tax limit. How much is the 2022 earned income credit.

November 16 2022 222 PM MoneyWatch. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial assistance to low-income working families with. All Californians regardless of their county race age or immigration status should have the support they need to make ends meet. However the amount of the credit is figured based on family size income.

Maryland provides a deduction for two-income married couples who file a joint income tax return. If you qualify for the federal earned income. Does Maryland offer a state Earned Income Tax Credit.

Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. If you are one. If you qualify for the federal earned income tax.

The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income. If you qualify for the federal earned income tax credit and claim it on your federal. Federal Earned Income Tax Credit.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis.

The state EITC reduces the amount of. 2022 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The maximum Earned Income Tax Credit amounts for the 2021 tax yearthe return youd file in.

If you qualify you can use the credit to reduce the taxes you owe and. The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit.

Filing Maryland State Taxes Things To Know Credit Karma

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

Maryland Income Taxes Are Due This Friday Eye On Annapolis Eye On Annapolis

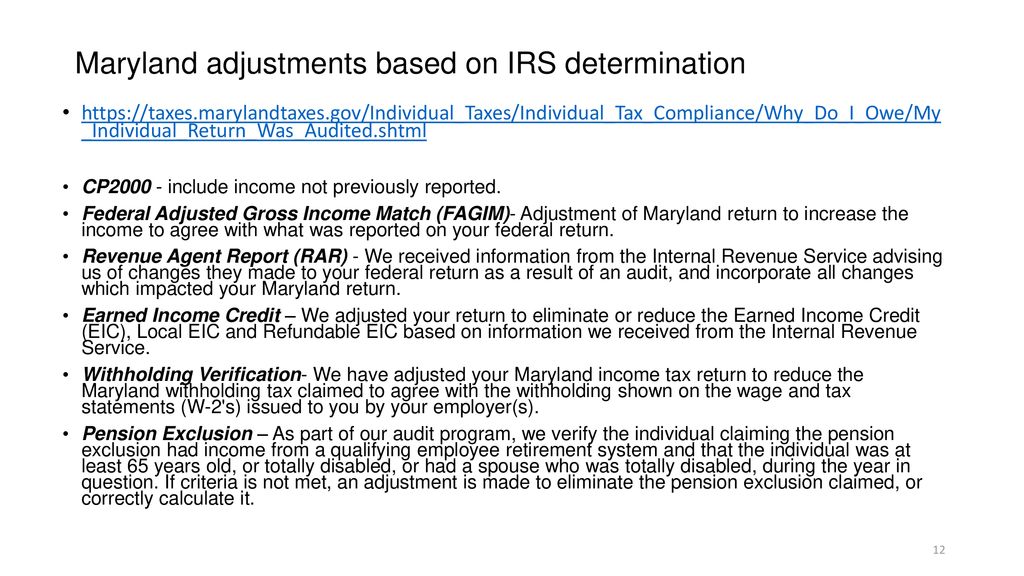

Maryland Audits Victoria Eve Kelly Esq Victoria Eve Kelly Llc Ppt Download

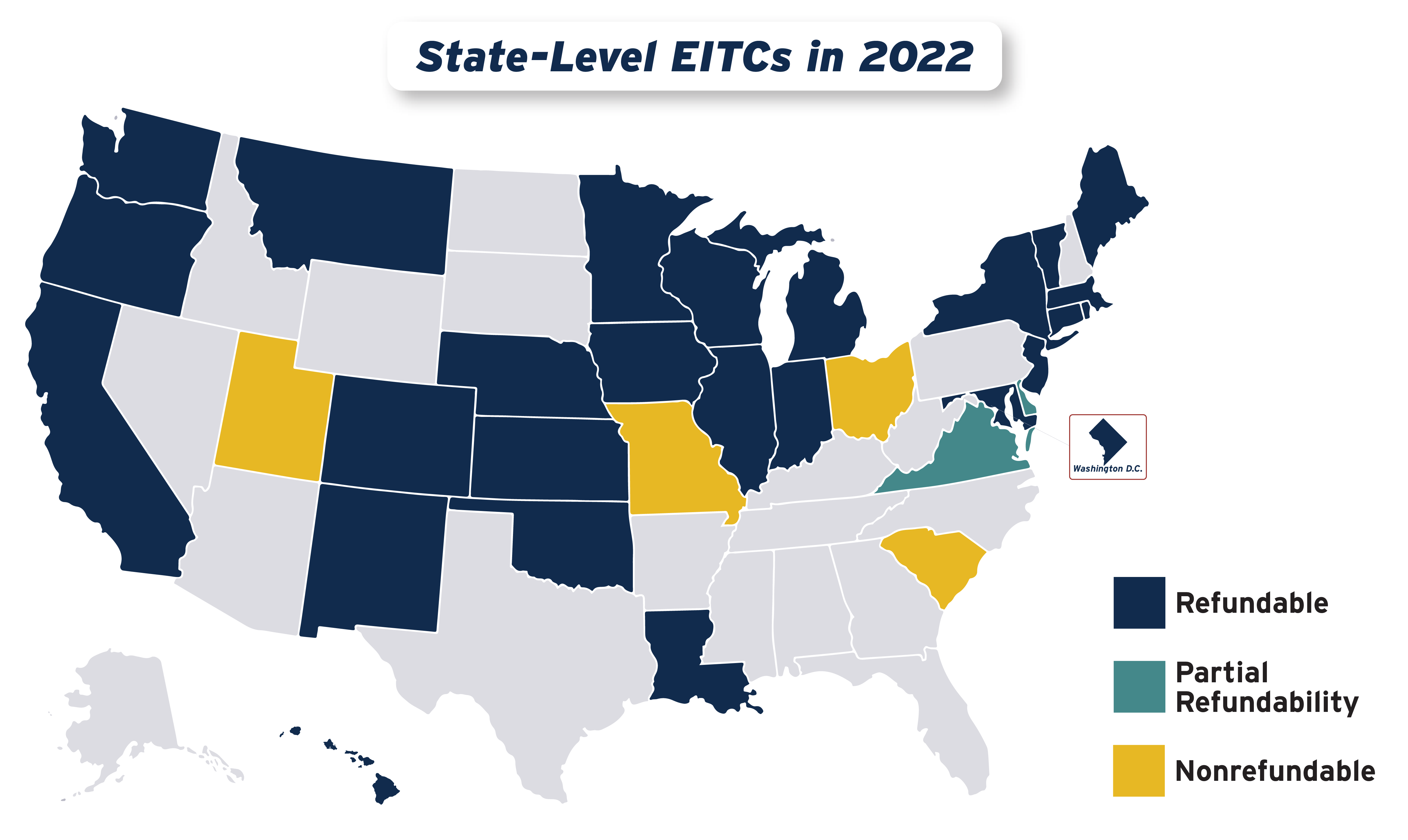

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Comptroller Of Maryland Last Week We Announced That We Are Extending The State Tax Deadline To July 15th For A Timeline On What To Expect In The Coming Weeks Here S All

State Earned Income Tax Credits Urban Institute

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Maryland Community Action Partnership Rescue And Relief Toolkits

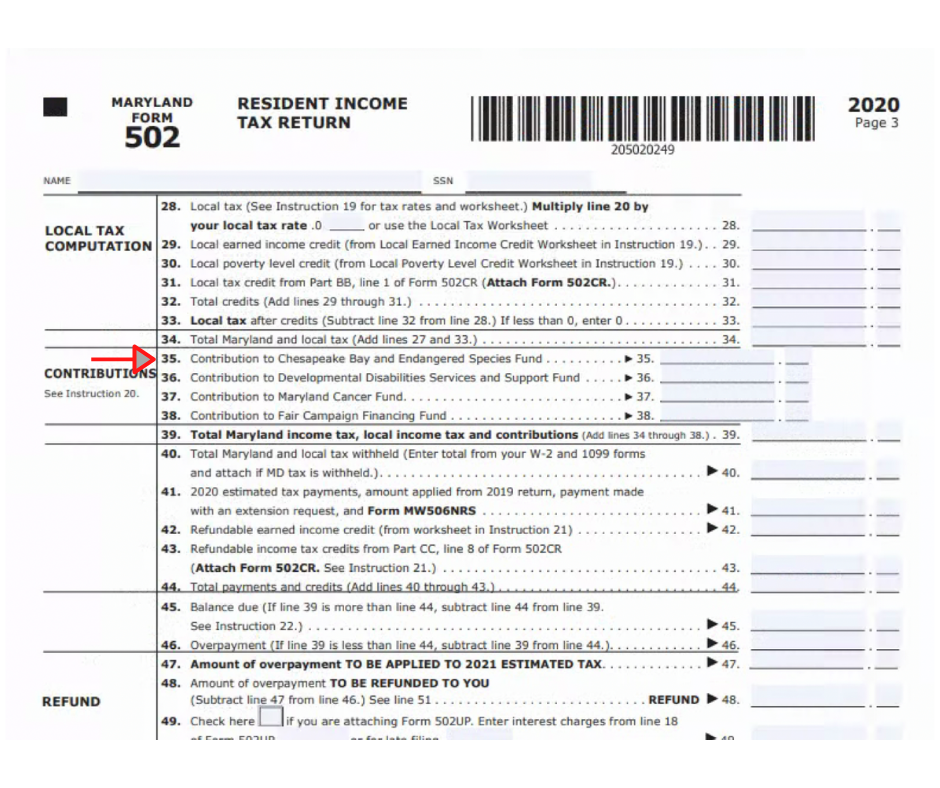

Form 502 Maryland Resident Income Tax Return

Maryland Volunteer Lawyers Service Eitc Can Give Qualifying Workers With Low To Moderate Income A Substantial Financial Boost To Receive The Credit People Must Meet Certain Requirements Use The Irs Eitc Assistant To Check

Introduction To Tax Law Part 6 Earned Income Credit 2022 Youtube

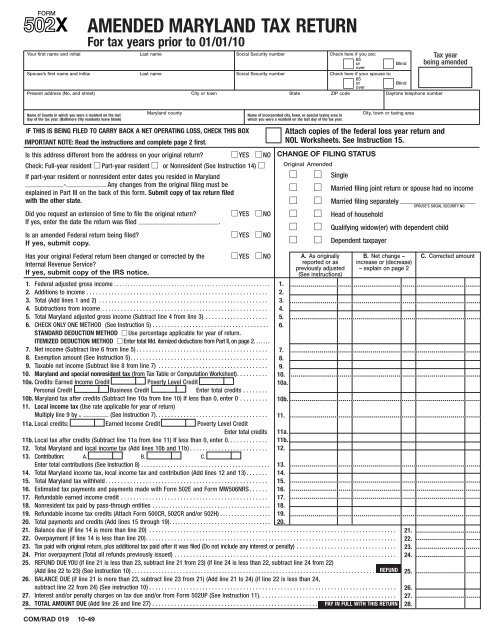

Form 502x Color The Comptroller Of Maryland

Comptroller Of Maryland Shopmd On Twitter Happy Monday Our Earned Income Tax Credit Calculator Is Live On Our Website You Can Find It Here Https T Co E5uz39xsac Https T Co Lqdwq0lh5b Twitter

Extension Announced For 2021 Maryland Income Tax Filing Payment

Mdhs Advises Eligible Marylanders To Utilize The Earned Income Tax Credit The Baynet

Gov Larry Hogan Announces 1b Covid 19 Relief Act Includes 750 Income Tax Credit For Maryland Families Cbs Baltimore